Introduction

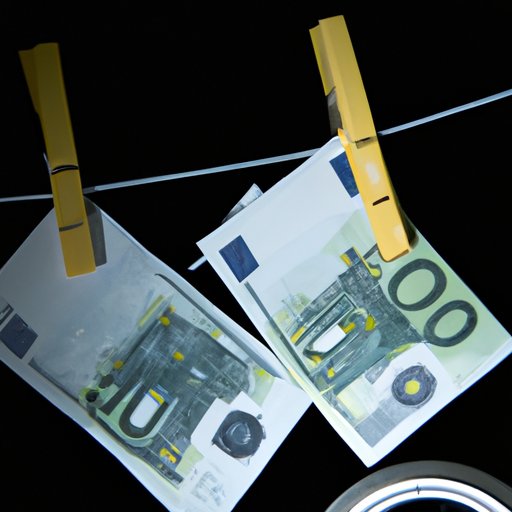

Money laundering is a financial crime that involves disguising illegally obtained funds by passing them through various transactions to make them appear legitimate. Layering is a crucial stage in the money laundering process, which involves moving funds through an intricate web of transactions to obscure their path and avoid detection. In this article, we will explore layering in money laundering and its significance in financial crimes, key elements, and techniques of implementing layering, advancements in layering techniques, legal compliance and consequences of layering, and how to combat it.

Techniques of Implementing Layering in Money Laundering

The basic idea behind layering is to execute multiple transactions that make it difficult for authorities to trace the origin or use of the funds. Some common techniques used are wire transfers, cash smuggling, currency exchanges, purchasing high-value assets, setting up elaborate business structures, and using intermediaries or shell companies. Successful implementation of layering requires a complex network of people or corporations to move funds around, obscuring the paper trail. Case studies of successful implementation of layering include drug trafficking, embezzlement, and cybercrime.

One example of effective layering in money laundering is the case of HSBC, a multinational bank that was fined $1.92 billion by the U.S. Department of Justice in 2012. HSBC was found to have worked with Mexican drug cartels, which used its services to launder billions of dollars. The money was moved through multiple accounts and transferred across borders, involving several intermediaries, shell companies, and fictitious names.

To detect layering, authorities use a variety of methods, including analyzing transaction patterns, monitoring account activity, and conducting background checks on customers. Financial institutions are required to report suspicious activity to regulatory agencies and coordinate with law enforcement agencies.

Advancements in Layering Techniques

As financial institutions and regulators become more adept at detecting and preventing money laundering, criminals have developed more advanced methods of layering. One such development is the use of virtual currencies such as Bitcoin, which facilitate anonymous and untraceable transactions. Criminals can use virtual currencies to move funds across borders without revealing their identities or leaving any traceable records.

Another advancement in layering techniques is the use of decentralized exchanges, which enable users to transact without the need for intermediaries such as financial institutions or regulatory bodies. Users can move funds anonymously and create their own digital currencies, making it more difficult for authorities to track or regulate.

Technological advancements have also made it easier for criminals to execute layering methods. For example, deep web marketplaces offer anonymous payment methods that allow for the seamless transfer of funds across borders.

Legal Compliance and Consequences of Layering in Money Laundering

Many countries have passed laws and regulations to prevent money laundering and combat layering. Financial institutions and other regulated entities are required to develop Anti-Money Laundering (AML) programs that detect, monitor, and report suspicious activities. They must also conduct due diligence on customers to ensure compliance with legal and regulatory requirements.

The consequences of layering in money laundering can be severe and include fines, imprisonment, and asset forfeiture. In some cases, financial institutions can lose their license to operate and suffer significant reputational damage.

Combating Layering in Money Laundering

Combating layering in money laundering requires a coordinated effort among financial institutions, regulators, and law enforcement agencies. Strategies include improving the detection and reporting of suspicious activities, sharing information across agencies, and enhancing international cooperation. Financial institutions are investing in technology to enhance their AML programs, while regulators are implementing stricter regulations and penalties. Law enforcement agencies are focusing on disrupting money laundering networks and increasing their capacity to investigate and prosecute financial crimes.

However, combating layering in money laundering requires constant vigilance, as criminals will continue to develop new techniques to evade detection. Future strategies may include the use of artificial intelligence and machine learning to analyze financial data, and the adoption of new regulations that cover emerging technologies such as virtual currencies and decentralized exchanges.

Conclusion

Layering is a crucial stage in money laundering, which involves moving funds through multiple transactions to disguise their origin and avoid detection. Understanding the techniques and advancements in layering methods is essential for combating financial crime and ensuring legal compliance. Financial institutions, regulators, and law enforcement agencies must work together to improve detection and reporting of suspicious activity, enhance regulatory frameworks, and invest in technology to identify and prevent money laundering networks. By staying vigilant and keeping up with new developments, we can protect our financial systems and prevent illicit funds from entering the global economy.